ZDNet’s recommendations are based on many hours of testing, research, and comparison shopping. This means each transaction is just a matter of tapping which product was being purchased and processing payment.‘ZDNet Recommends’: What exactly does that mean?

Take time to add your product line into the sales system. It will work with your existing PayPal account. Units already using PayPal for things like rechartering fees or camps should probably go with the PayPal reader. This will help you know whether that random $75 was for popcorn sales or winter camp. Use the built-in memo field within the app to categorize each transaction. “The extra sales more than made up for the expense of the cellular plan and the service charge for taking cards,” one leader said. Some units have used an old iPhone, set it up on a prepaid plan - $40 or so for 1 GB of data, which is plenty - and set up the phones so the only icons visible are the chip-reader app and the calculator app. Remember that these readers work best when the phone is connected to the internet. Some of these companies charge for things like manually keyed-in card numbers. Read the fine print for additional fees. What else should I consider when using these? Once again, don’t forget about the processing fee. It’s all about convenience for our Scouting families. Now that you have the card reader and account set up, why not use it to accept other unit-related payments? This could include dues, camp fees and more. QuickBooks GoPayment Chip and Magstripe Card ReaderĬontactless (Apple Pay, Google Pay, etc.) Most Scouters I’ve heard from use one of these three readers: Name What are the best options for card readers? 1 2015, sellers - not credit card issuers - are on the hook for fraudulent charges when the customer has a chip card but the seller swipes instead. Having a card reader that can accept chips isn’t just a good idea it could reduce your liability in fraud cases. Credit and debit cards now come with built-in chips meant to make the card information harder to steal. #Bluetooth credit card reader square how do i connect android

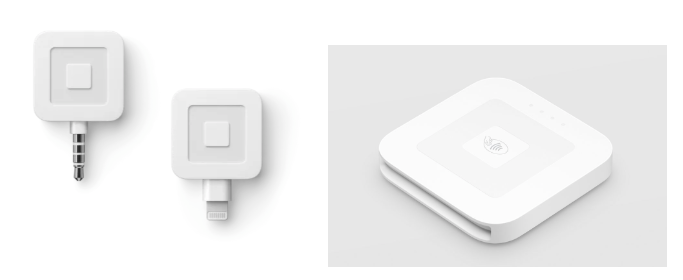

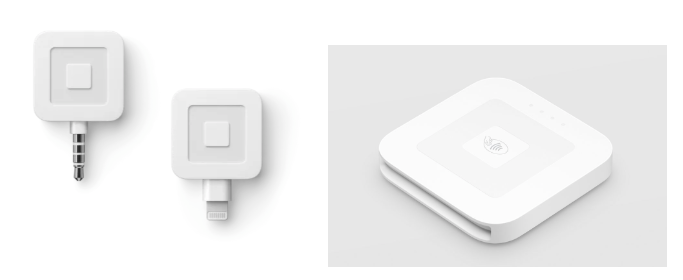

Apple Pay and Google Pay: Each of the three companies listed here offers a reader that can accept Apple Pay and Google Pay (formerly called Android Pay).Ĭredit card technology has changed, too. Square, PayPal and QuickBooks each offer Bluetooth-enabled readers that connect wirelessly to your phone or tablet.  Wireless card readers: No headphone jack? No problem. That means, for example, you could allow a parent to process sales but leave refund power to a handful of registered leaders.

Wireless card readers: No headphone jack? No problem. That means, for example, you could allow a parent to process sales but leave refund power to a handful of registered leaders.

You can email receipts to customers with ease, accept tips and give access to multiple people. Better apps: The companion apps that pair with the physical readers have improved greatly.Six years later, the three readers I mentioned back then - from Square, PayPal and Intuit/QuickBooks - remain the three best options.īut many other aspects of credit card readers have changed. I first blogged about accepting credit cards for popcorn sales in 2012. That’s not nothing, but sacrificing 82.5 cents on a $30 can of caramel corn is better than missing out on the sale entirely. The companies behind the readers charge a fee per swipe or chip read. (I’ll tell you why a chip-enabled reader is a good idea later in the post.) First, there’s an up-front cost for the newer readers that accept chip cards.

I’ve heard from packs and troops that have enjoyed a jump of 10 to 20 percent or more once they started taking credit cards. Units that add these readers see an instant increase in sales. With a few taps, the money can be deposited into your unit’s bank account in a day or two.

3, 2018 with the latest info.ĭon’t let a cashless customer walk away that easily.īy adding a cheap credit card reader, your pack, troop or crew will be equipped to accept plastic for popcorn sales and other in-person, show-and-sell-type fundraisers.

0 kommentar(er)

0 kommentar(er)